Part 2: Cryptoassets - reality check before a new rise?

Private banks, ETC providers, depositories, asset managers - the list of traditional market participants now dealing in cryptoassets is long. The days when Bitcoin and Ethereum were the preserve of die-hard experts are long past.

Monetary policy reversals by major central banks, record-high inflation and uncertainty due to tight supply chains and sanctions against Russia have led to massive volatility across nearly all asset classes. The market movements represent opportunities for trading-oriented investors. The days when adequate returns could be achieved with buy-and-hold strategies due to stable macroeconomic conditions seem to be over for now. However, to take advantage of the opportunities, a reliable, precisely tailored data supply, preferably real-time, plays a much bigger role.

Part 2: Cryptoassets - reality check before a new rise?

Private banks, ETC providers, depositories, asset managers - the list of traditional market participants now dealing in cryptoassets is long. The days when Bitcoin and Ethereum were the preserve of die-hard experts are long past.

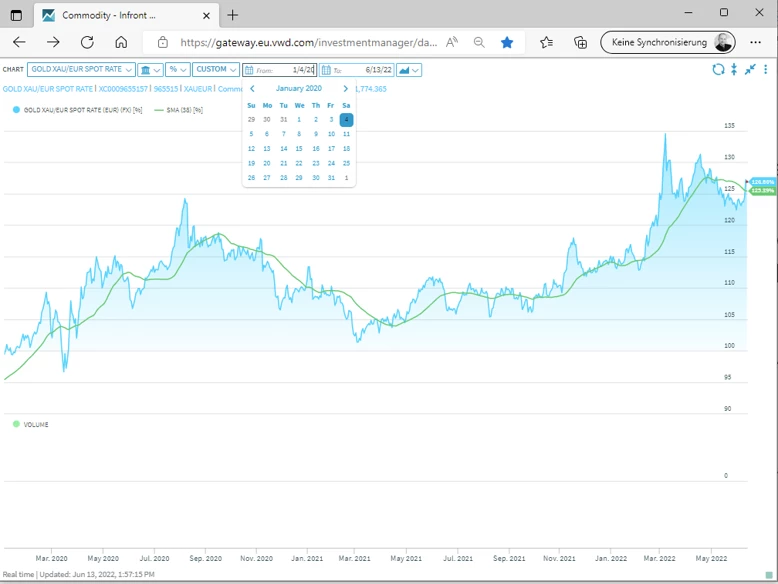

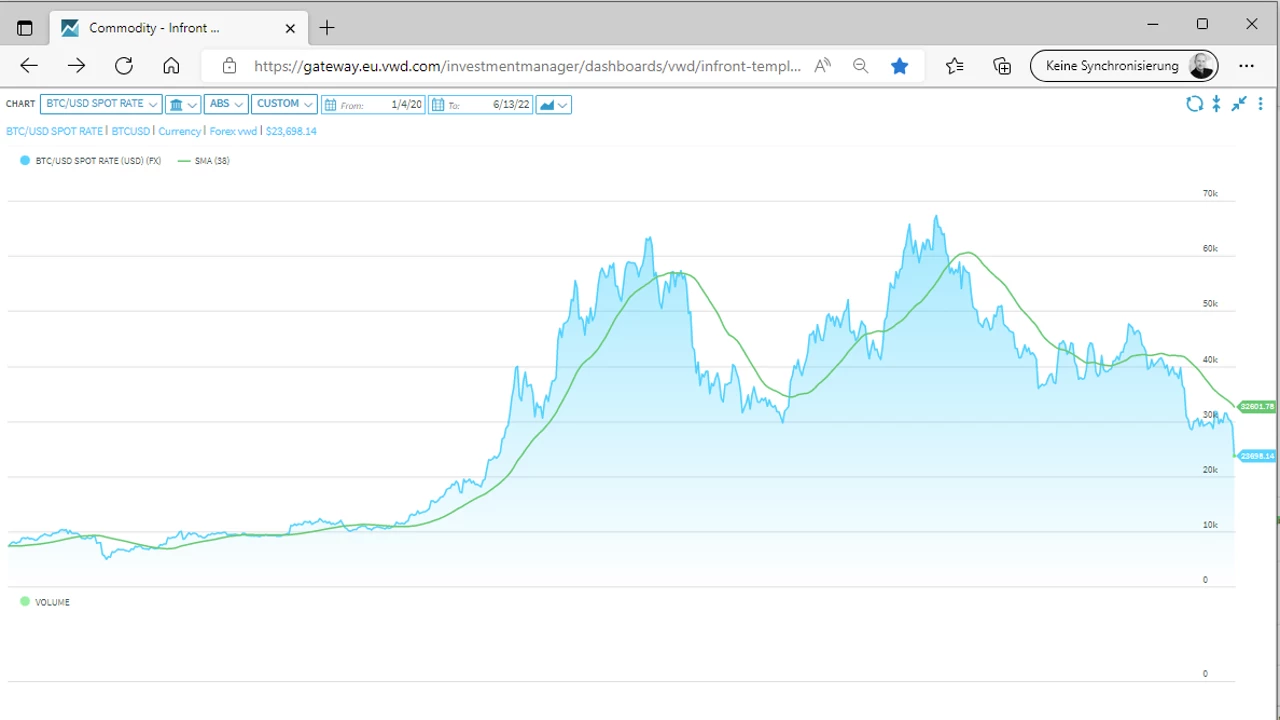

The reason cryptoassets are still a very attractive asset class for investors can be seen in the logarithmic chart for Bitcoin, which is still the largest cryptocurrency.

This is a reasonable representation for values that multiply at regular intervals and shows that the recent fall in price was not exceptional. The bitcoin price has still increased many times over in the past two years.

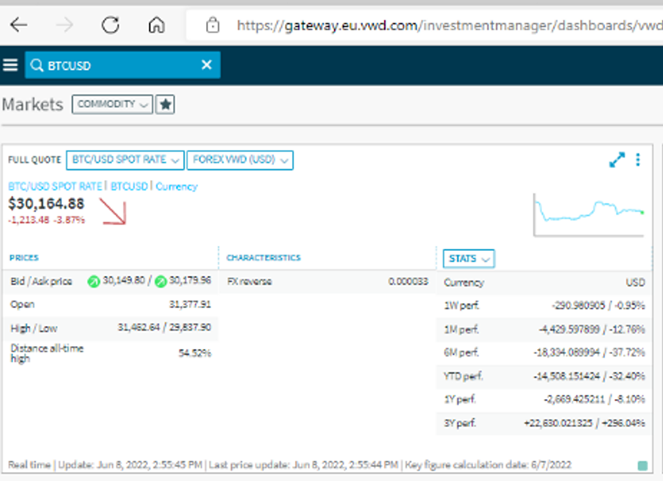

Infront Investment Manager, Relative chart, prices: BTCUSD Source: CBAG, Crypto Broker AG

Infront Investment Manager, Absolute Chart, Rates: BTCUSD Source: CBAG, Crypto Broker AG

Two developments, in particular, should be closely watched by interested investors:

Regulation and Decentralized Finance (DeFi)

For investors, regulation is a double-edged sword. While it creates legal certainty and simplifies investments, it can also lead to unwelcome side effects. One example is the European Union's MiCA (Markets in Crypto Assets) regulation, currently being negotiated between the EU Parliament, Commission and Council. Clear regulation of investment in crypto assets across the EU could provide an important boost to the industry. On the other hand, it could then lead to restrictions on Bitcoin, as securing new blocks cryptographically (i.e., "mining") consumes huge amounts of energy. This would run counter to the EU's "Green Deal," which aims precisely to channel capital into sectors that use less energy and resources. The EU cannot ban Bitcoin since no individual or institution owns it. However, exclusion from MiCA could trigger renewed price fluctuations, so it is important to follow the news closely here.

Decentralized Finance (DeFi) describes the development of a self-sufficient ecosystem that is independent of the traditional financial market. For example, banking services are offered and remunerated on the basis of blockchain applications (deposits or loans for a corresponding interest rate) without the involvement of a traditional bank. All this is based on programmed algorithms (smart contracts). Users have deposited assets currently worth around 55 billion US dollars in this market segment (defipulse.com).

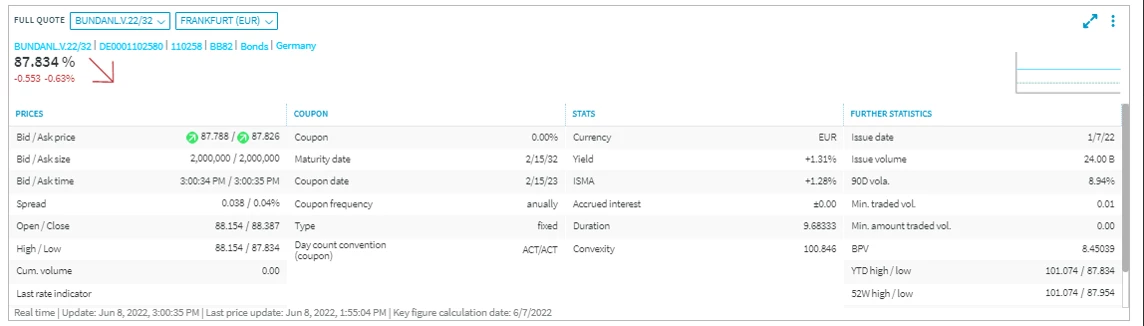

To compare and better classify this figure - this corresponds roughly to the average volume of two 10-year German federal bonds. Thus, the total volume of smart contracts can still be described as expandable.

Infront Investment Manager, Bundesanleihe 2032 Quelle: .FRA - Frankfurter Börse

It is better to view investing in corresponding tokens from the perspective of private equity. The value increases the more users can be convinced of the respective business model. The crux: these are very young projects, not all of which will survive. Others, however, may rise sharply if there is sufficient demand since crypto assets work globally and have, in principle, unlimited market access.

Currently, master data of exchange-traded instruments come from special data aggregators or the exchanges directly. This type of centralised facility for master data of crypto assets or NFTs in general does not yet exist. Thus, the data supply for vendors of master data in crypto is rather difficult. As long as these data aggregators do not act as a central data collection point, a unified data situation for crypot assets will probably remain a challenge.

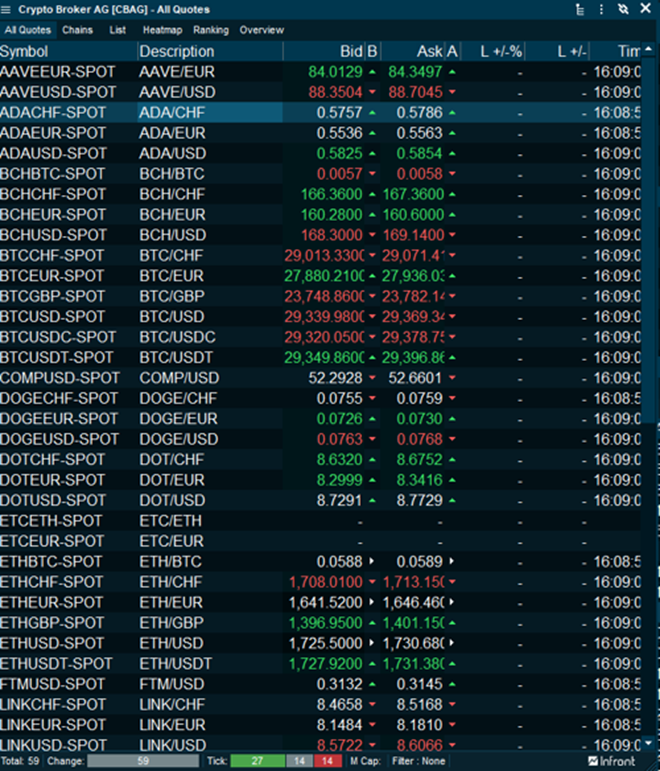

Another detail is the processing of trades. This requires permanent quotation for a functioning market. (The figure shows some of the available spot market rates.)

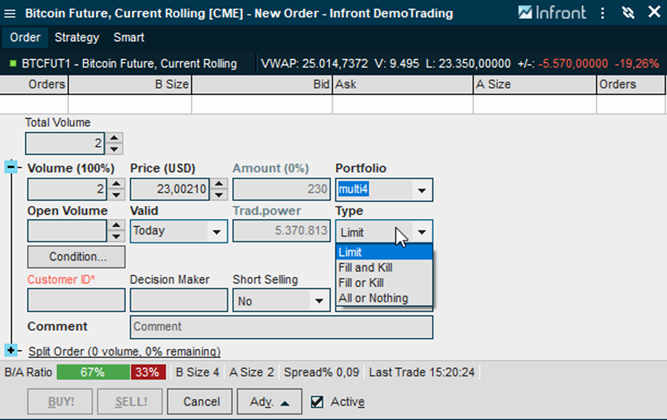

Equally important are custodians or depository banks that process the transactions. Trading and clearing of crypto FX rates is possible through the Infront Professional Terminal for Trading. Other crypto instruments such as bitcoin futures on the CME exchange can be transmitted to brokers or bank trading desks from the trading screen.

Other Infront services such as scenario calculation for packaged retail and insurance-based investment products (PRIIP) are difficult to present in the crypto area. On the one hand, the price histories are not available to the same extent as for exchange-traded securities. On the other hand, the batch sizes are many times smaller. A Ferrari oldtimer, for example, is a solid investment worth millions of euros. If it is to be made tradable as a token, then even for such an individual item the effort required to create a PRIIP document is relatively high and without this it is difficult to make the product tradable in the retail segment.

In summary, the following can be stated from a vendor's point of view: Crypto - FX cash quotes play a rather minor role as a price source within the daily cash management of the core/treasury management systems and are rarely demanded. A similar picture can be seen with other payment service providers.

In wealth management, price data for cryptocurrencies seems to be used more in the retail sector than in professional asset management. The latter, however, is watching the crypto sector very closely. New custodian offerings from private banks underline this picture to some extent.

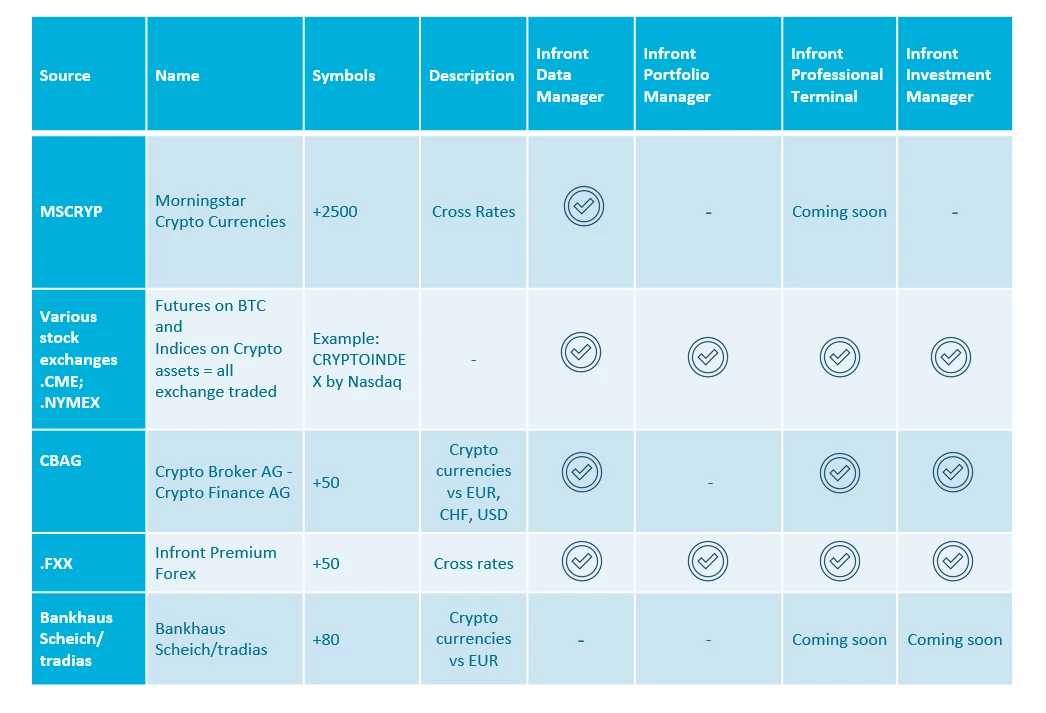

With Infront products, you can already follow numerous crypto price sources and with Crypto Broker AG, a custodian is already available.

Supported by Tobias Hartmann, Infront

Back to all news

Back to all news