While regular (regulatory) reporting, supplied on paper or as a PDF in the postbox module, will likely continue to exist, we have noticed that the digital customer channel is increasingly used, measured by the number of our customers, the number of end-users and the depth of use.

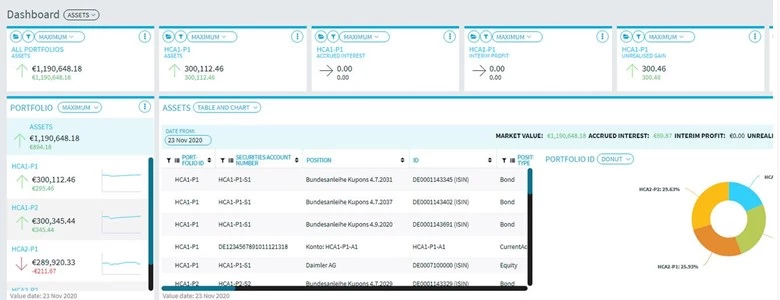

With the latest updates and releases for the Infront Portfolio Manager and Infront Customer Account, we have optimized our solution accordingly: In addition to the extension of the multiple views, e.g. tabular overview, asset, region and risk classes to assets per portfolio in total and in detail transaction list, performance and risk. We have also added widgets for yield, profit & loss, maturities, cash flow forecast.

We will continue to add new functionality with upcoming updates and releases: In Q1/2021, data provision will be significantly simplified by moving the upload workflow from the server to job control, which will be accessible to all authorized users. This will allow advanced parameterization of the uploaded data, such as setting the length of the history or the calculation method for performance. Further customization is also planned by adding user-defined fields to the data scope and extending the market data coverage to benchmark comparisons for performance as well as market information on e.g. key indices on the 2021 roadmap.

Infront Customer Account is the digital solution for your customers to offer your classic asset management online in the future and to expand your range of services digitally.

Back to all news

Back to all news