Infront Professional Terminal

What's new?

Updates on developments in the Infront Professional Terminal

New Features in 8.6.700 Release

ESG risk scores in Bond and Fund Overview

With the Infront ESG Module, Fund specific scores are now an integrated part of the Fund Overview with 3 levels of granular ESG data gauging the specific funds exposure, risk mitigation and opportunities.

The same applies to the Bond overview, where corporate bonds apply the respective issuer rating while treasury bills and government bonds include government specific scores. These scores show how different states address and provide political stability, environmental subsidies, tax incentives etc. in order to attract foreign investments and support technological innovation.

You can now calculate and chart yield curve spreads directly in the curve chart. This allows for spread analysis on multiple forward looking yield curves and easy switching between them.

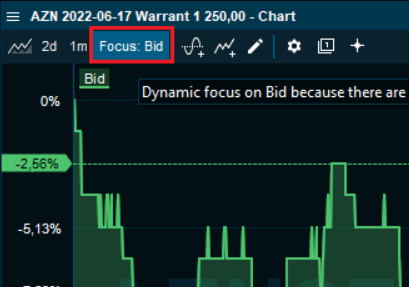

For certain illiquid instruments, bid and ask prices provide a better picture of the market price development in the absence of actual trades. The new “Dynamic Focus line” in charts automatically detects this and changes the chart parameter accordingly for illiquid instruments or specific periods in time. Consequently, the market view is improved without any manual user interaction. An info message will appear if this occurs and the feature can be turned on or off to your preference.

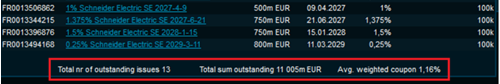

The Debt Maturity profile has been optimized to accommodate various debt profiles providing an improved visual presentation and granularity of each bond. In addition, the number of outstanding issues along with the total outstanding amount and weighted coupon can now be found at the bottom bar of the window:

Product Update for the Infront Corporate Debt Module - Dec 2021

We are pleased to inform you about the improvements that have been made in the Corporate Debt Module. Credit ratings and bond reference data have been added along with newly developed features. Bond pricing data, from more than 20 contributors, has been added. Additional contributor sources will continue to be added to this module.

What does this mean for you? Significantly strengthened content for credit risk and corporate bonds as well as newly developed functionality, has increased the value of the Corporate Debt Module.

-

Credit ratings are provided by market-leading rating agencies S&P and Moody’s and include ratings on the individual bonds at the issue-level as well as the overall company issuer level

-

Bond pricing data has been added from more than 20 contributors

-

Coverage of bond reference data across Europe has been expanded to more than 90 reference data fields for over 500,000 bond issues

-

Newly developed Debt Maturity profile visualizes outstanding bonds and their respective characteristics

Evergrande debt crisis in IPT - 06.10.2021

Combining credit ratings with new features we are able to deliver insight and value to our clients within the fixed income and credit risk area. The current Evergrande situation unraveling in China's real estate market acts as a dire showcase with potential ripple effects for the global economy.

With our Corporate Debt module, the following IPT desktop provides the debt profile and credit risk of Evergrande. Availability of critical rating downgrades and the different terms and properties at which their bonds trade at enable our clients to discover the risk sentiment in the market and see the implications it might carry to their portfolios.

IPT 8.6.500 Release

Credit ratings and WM data internally launched in Infront Professional Terminal.

As the next step in our integration plan and fixed Income strategy, we are pleased to introduce credit ratings and WM data in the latest version of our Professional Terminal - 8.6.500.

Following the integration of contributor bond data last year, credit ratings provide an added layer of insight into the debt market and its inherent credit risk.

Ratings data is provided by the market leading agencies S&P, Moody’s and Fitch* and includes ratings on the individual bonds on the issue level as well as the issuerR on the overall entity level.

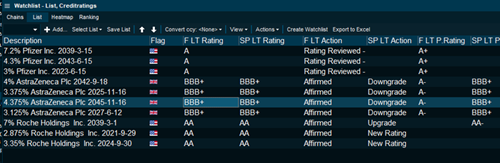

With the new ratings columns you can easily filter a complete market based on Investment grade or your preferred level by simply sliding the column filter bar.

Rating distribution within a market or segment can be viewed in addition to when the Ratings was last updated and what the action was.

In combination with our bond screener you can identify different bonds from the same company across issuing entities and further consolidate them in a Watchlist to uncover any rating variations across the issuers loans or typical peers within a sector:

The Bond overview features a new tab which consolidates all this data across the ratings agencies on the Individual bond level:

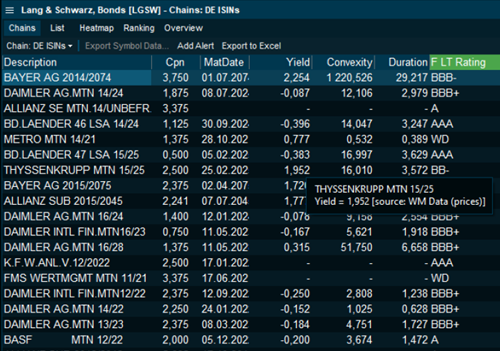

The WM reference data which is important for the german fixed income markets in particular, is now available for testing and is indicated by a hover over to clearly indicate tjhe source. More importantly we are now able to deliver high quality data to even more reference fields within our Bonds universe - a key point for integration.

For more details as well as info on packaging and pricing, please refer to the internal release notes.

IPT 8.6.600 Release - ESG

Complete IPT desktop sector filtered Xetra market showing level 1 and 2 and hover over for level 3.

ESG plattform linked to Xetra Market. Watchlist across countries and markets:

Updated Spider chart:

LIBOR transition 2021- reference interest rate expired

Read more about the risk free rates offered in the Infront Professional Terminal.

Infront Corporate Debt Module with new content for credit risk and corporate bonds

We are happy to inform you today about our latest improvements in the Corporate Debt Module in your Infront Professional Terminal. Credit ratings and bond reference data have been added along with newly developed features. Bond pricing data, from more than 20 contributors, has been added. Additional contributor sources will continue to be added to this module.

What does this mean for you?

Significantly strengthened content for credit risk and corporate bonds as well as newly developed functionality, has increased the value of the Corporate Debt Module

- Credit ratings are provided by market-leading rating agencies S&P and Moody’s and include ratings on the individual bonds at the issue-level as well as the overall company issuer level

- Bond pricing data has been added from more than 20 contributors.

- Coverage of bond reference data across Europe has been expanded to more than 90 reference data fields for over 500,000 bond issues.

- Newly developed Debt Maturity profile visualizes outstanding bonds and their respective characteristics

The Infront Professional Terminal Corporate Debt Module consolidates fundamental data, OTC and exchange pricing for corporate debt instruments in one complete solution.

Tullett risk-free rate derivatives are now available

- Tullett RFR derivatives are included in Treasury module

- You can find all instruments in the regular Tullett feed ( TIM – feedno:2227)

Example of Tullett RFR instruments:

- TIM > OIS > USD > You can find Act/360 v SOFR swaps

- TIM > Currency basis swap > JPY > You can find TONAR v SOFR basis swaps

All derivatives and swaps related to risk-free rates from Tullett is available on the TIM feed.

We have also updated the page “LIBOR Alternative risk-free rates” so users can navigate and find the new instruments.

Here is a selection of the instruments available:

| EUR ESTR | |

|---|---|

| EUR ESTR OIS | 1W-60Y |

| ESTR/EURIBOR 3M Basis | 1Y-50Y |

| Forward ESTR OIS | 0x1M-21x24M |

| Forward ESTR OIS - ECB Meeting Dates | Dates # 1-10 |

| Forward ESTR OIS - IMM Dates | Dates # 1-10 |

| FRA/OIS Spread-IMM Dates | Dates # 1-10 |

| ESTR/SOFR 3M Basis | 3M-50Y |

| ESTR/Fed Funds 3M Basis | 3M-50Y |

| GBP SONIA | |

|---|---|

| GBP SONIA OIS | 1W-70Y |

| Forward SONIA OIS - MPC Dates | Dates # 1-12 |

| Forward SONIA OIS - IMM Dates | Dates # 1-12 |

| FRA/OIS Spread - IMM Dates | Dates # 1-12 |

| FRA/OIS Spread - MPC Dates | Dates # 1-8 |

| SONIA/3M LIBOR Basis | 1Y-70Y |

| SONIA/Fed Funds 3M Basis | 1Y-30Y |

| SONIA/Fed Funds Spread - IMM Dates | Dates # 1-8 |

| SONIA to Maturity | B01-B58 |

| SONIA/GBP Futures Gilt Spread | 10Y |

| IRS & OIS 10Y Invoice Spread | 10Y |

| USD SOFR | |

|---|---|

| SOFR OIS | 1W-50Y |

| Forward SOFR OIS - FOMC Meeting Dates | Dates # 1-20 |

| FRA/OIS Spread - IMM Dates | Dates # 1-20 |

| SOFR/Fed Funds Basis | 3M-50Y |

| SOFR/Fed Funds Basis - IMM Dates | Dates # 1-20 |

| SOFR/LIBOR 3M Basis | 3M-50Y |

| SOFR/LIBOR 3M Basis IMM | Dates # 1-20 |

| EONIA/SOFR 3M Basis | 3M-50Y |

| SOFR Treasury Basis | 2Y-30Y BMK |

| SOFR/ BSBY 3M Basis | 3M-50Y |

| SOFR/ BSBY 3M Basis IMM | Dates # 1-20 |

| Single Period Swap | Dates # 1-8 |

| SOFR/Treasury Spreads | 2Y-50Y |

| BBSW/SOFR Basis | 3M-30Y |

07.05.2021 - Infront Mutual Funds is now available in the Infront Professional Terminal

Leveraging on Infront’s industry network, scale and market reach we are pleased to introduce Infront Mutual Funds, now available to all clients of our Professional Terminal.

As a part of Infront’s growth, an important step has been building independent content. Based on both strong relationships and technical infrastructure, we now provide direct contribution from fund managers, in one consolidated universe, on one attractive platform with powerful reach for both buy and sell side.

The Infront Mutual Funds holds more than 125 000 funds across European markets including NAV prices, historic data, dividends, respective dividend policy, ongoing charges and risk levels to name a few fields in this comprehensive data set.

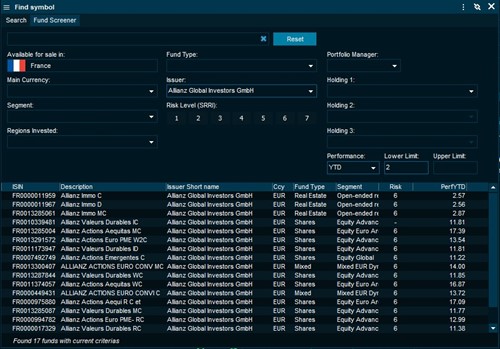

Features include a powerful Fund Screener enabling you to identify funds to your specific preference or mandate based on issuer, specific holdings, fund type and exposure, risk levels and more. Moreover the Fund Overview provides details of the individual funds performance and risk metrics along with Assets under Management and Investment Mandate. For an optimized workflow, historic performance can be compared and viewed directly in the integrated chart and KIID documents are easily available.

The Infront Mutual Funds dataset may also be structured as columns in a watchlist allowing for a tailored view, sorting and ranking of funds, all fully exportable to Excel.

The dataset is applicable to all general terminal features and seamlessly integrates with your familiar setup adding even more content and value to our Professional Terminal.

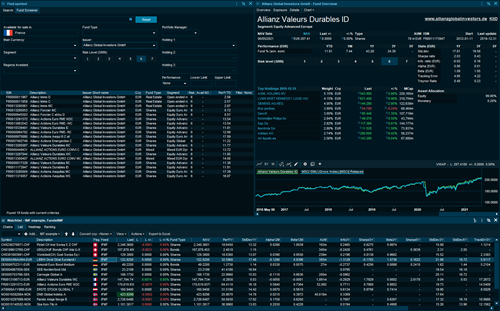

Here you can find an example desktop:

Fund Screener:

Individual Fund Overview:

Access from magnifying glass in the search top left corner:

Or from the main menu under “Tools”:

04.03.2021 - Infront Professional Terminal 8.6.400

Date specific historical lookback and compare in curve chart

Discover how forward, swap or yield curves reacted to historical events such as ECB announcements, Inflation news and market incidents on specific dates. The date-specific lookback allows you to uncover movements and shifts in the curve for a particular day in question and enables you to pinpoint your preferred point in time

Debt maturity profile

A visual breakdown of a company’s issued debt, when it is maturing and respective notional outstanding amount. You can hover each bar to view coupons and additional data. If bonds are issued in different currencies the chart automatically currency converts to your selected conversion currency in order to compare them to scale in one axis.

Drag and drop symbol from Instruments to watch list

Volatility smile

The Volatility smile charts the Volatility of an Option across Strike prices. It visually represents how Options with the same underlying and expiry date are valued base on implied volatility across strike prices.

Chart performance for a custom period

Now its possible to quickly zoom in on a particular time period within a chart and the percentage performance on the left axis will adjust automatically recalculating the return for that period.

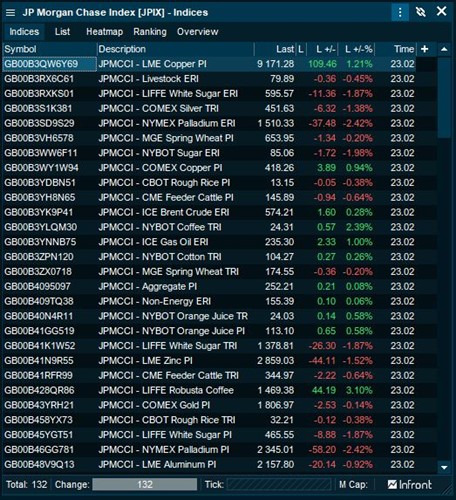

JP Morgan Chase indices are now available in the Infront Professional Terminal

01.07.2020 - New features and content in Infront Professional Terminal

Get real-time global market data, news, analytics and electronic trading, in a modular solution that you can easily tailor to your needs. With fast and powerful search, analytics and alert tools, you can cut through the noise and gain unique market insight for better investment decisions. What are the new features and content?

New content in the Infront Professional Terminal

In the new version of Infront Professional Terminal (will shortly be available for clients) we have added news in local language from various news agencies and new content feeds as follows:

- AWP:

Swiss news provider offering coverage in German, French (some Italian) - Dpa-AFX:

Pro feed for German, International pro in English - Dow Jones:

Dow Jones Global, German news

Dow Jones Compact, German news

New content feeds in the Infront Professional Terminal with a list of contributors, markets, exchanges, brokers including ICAP:

- Baader Bank

- BayernLB (Bayerische Landesbank)

- Credit Suisse

- Deutsche Bank Autobahn

- DZ Bank Bonds

- European Central Bank

- German Government Bonds

- German Federal Bank (Deutsche Bank)

- Lang & Schwarz

- Quotrix

- XtrakterBondprices

- ICAP (optional data packages)

- LBBW

New features in the Infront Professional Terminal

In the new version 8.6.300 (will shortly be available for clients) helpful features such as the VWD pages, all listings and a fund module with mutual fund data will be implemented.

VWD pages

Users of the vwd market manager know these very helpful preformatted pages that make it easy and fast to find a whole list of all instruments. They provide an easy way to search for instruments primarily by contributor source on prepared market pages. vwd Pages users can export the instruments on the page to Infront Professional Terminal watchlist for further navigation as a fully integrated Infront Professional Terminal instrument.

All listings

This is the “Arbitrage” window in the vwd market manager and the functionality is now also available in the Infront Professional Terminal. All Listings quickly show real-time pricing of one stock across all available traded venues with full order depth, spreads, trade volume etc. Certain clients who act as Market Makers need to quickly see marginal price differences (or arbitrage) across venues. This is beneficial for advisors, traders and brokers to ensure the best execution.

Fund Module with Infront Mutual Fund data

The Infront Mutual Fund Module contains our own Infront fund data (all former vwd fund data) as well as Infront Professional Terminal native fund screener. This fund overview allows users to access the different data fields and information that is available in the database screen on different fund parameters to display particular fund information.

The new version will also include multi-language Investment Mandates meaning that you are not restricted to the language in your Infront Professional Terminal. Most recent KIID documents are based on application and language preferences.

And in the charting, there will be a chart comparison benchmark.